BY JONIEL CHA

Joniel Cha is a first-year International Economics and Energy, Resources, & Environment major at SAIS.

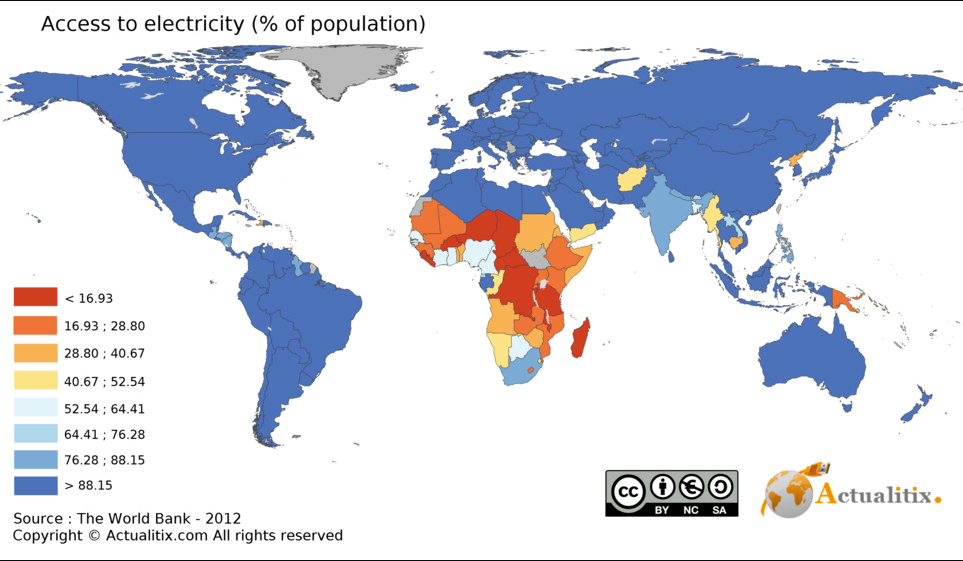

Over 620 million people in Sub-Saharan Africa (SSA) – roughly two-thirds of the region’s population – lack access to electricity (IEA 2014) (see Figure 1). The overall electrification rate for the region is 31% and less than 10% of rural households have access to electricity (Zaitchik 2017). Of the region’s grid-connected households, 40% do not pay their bills.

The region’s energy generating capacity has remained stagnant for the past 30 years, causing a significant drag on GDP growth. Universal electricity access will require over $400 billion (IEA 2014). SSA is rich in energy resources, many of which are still untapped. Tapping into renewable forms of energy such as solar, geothermal and wind alone could meet the current demand. At the current rate, however, not only will half of the region’s population still be without electricity by 2030, but the proportion of the population relying on traditional fuels for household energy needs will also remain the highest in the world (UNEP 2012).

The acute shortage of access to electricity in SSA presents a strategic opportunity for energy companies to invest in electrifying the region quickly and sustainably. This can be done by instituting certified emission reductions (CDM credits) traded at high price levels and creating a level playing field in terms of profitability between innovative renewable energy technologies and conventional fossil fuels-based electricity generation options. Energy is, after all, critical to a region’s social and economic development and a source of revenue for much-needed investment in infrastructure.

Figure 1: Access to Electricity (% of Population) (Actualitix, World Bank, 2012)

Globally, the appeal of renewable energy technologies has progressively improved due to two major factors. First, these technologies open new export opportunities and revenue streams. This is mainly because of their eligibility for carbon crediting on international carbon markets underpinned by the Kyoto Protocol. In this system, developed countries pay developing countries to invest in local infrastructure. Second, innovation, driven by increased market demand, has reduced prices for renewable energy considerably over the past decade (Deichmann et al. 2010). Wind and solar power, for instance, are now exploitable in stand-alone units or mini-grids. This eliminates the cost of connecting them to the main grid and ensures that the energy produced is distributed in a decentralized and modular manner across rural areas. It is precisely in such rural areas that small grids or off-grid solutions are most feasible. It is estimated that 66% of the population in SSA lives in such regions.

The main investment in meeting the energy needs of the SSA region over the last decade, however, have been in fossil fuel or hydro-based (hydroelectric) power generation. Not only are these forms of energy production costly due to the lack of potential for economies of scale in the small size of the electricity markets, but also both means of energy production also adversely affect the region’s economies and population. In particular, dependence on fossil fuels exposes the SSA countries to price volatility in these markets and foreign supply chains. Additionally, each year nearly 600,000 premature deaths in Africa can be attributed to household air pollution resulting from the traditional use of solid fuels (IEA 2014).

On the other hand, while hydroelectric power is a renewable source of energy, its development can result in serious environmental damage and social conflict, particularly in the case of large-scale dam-based generation. It is also vulnerable to droughts, a particularly pertinent risk category in SSA. So, while other sources of renewable energy such as wind, solar, and biomass might be better suited to many African countries, these have been largely neglected (UNEP 2012).

In the context of the SSA region, therefore, solar energy is a particularly feasible source of renewable energy. Solar energy is naturally decentralized, available in huge supply, improving in cost-effectiveness as the technology advances, is relatively more immune from supply or price uncertainty, and is eligible for support from bilateral and multilateral institutions that are seeking to increase low-carbon energy production (Deichmann et al. 2010). The SSA region is richly endowed with solar energy resources suitable for photovoltaic solar systems and for large-scale solar thermal facilities.

Despite the vast potential for harnessing renewable energy, addressing the region’s energy deficit will require significant finances. A large financing gap exists in SSA because the focus of much of the current spending is on maintenance and operations of the existing power infrastructure, with little remaining to fund long-term investments to address the power supply gap (UNEP 2012). In the past, one of hydro-based, gas- or coal-fired generation has often been the most cost-efficient option, making it the preferred political choice as well (UNEP 2012). Additionally, fossil fuel subsidies lower the price of energy generated from fossil fuels, artificially making them more competitive relative to renewable energy alternatives.

Other than the paucity of funds, weak institutions, lack of law enforcement, manipulation of electricity prices for political reasons, exchange rate volatility, and the lack of technical and managerial expertise in both the public and private sectors also serve as significant barriers to potential investment.

Having outlined the energy problems in SSA and the feasible use of renewable energy technologies, the following recommendations are presented to the governments of Sub-Saharan countries and international donors to attract private investors:

· Institute markets for certified emission reductions (CDM credits) traded at high price levels. The Green Climate Fund, Climate-focused Multilateral Insurance Guarantee Agency, and Climate-focused Currency Exchange Fund are funding mechanisms to attract the private sector to invest and operate in SSA. These international bodies offer mitigation solutions for private investment in developing countries. CDM credits under the Kyoto Protocol are intended to deliver cash payments from developed countries to developing countries to invest in local infrastructure. The Clean Development Mechanism has also played a role in most non-hydroelectric, grid-based renewable energy development in SSA.

· Create a level playing field in terms of profitability between innovative and promising renewable technologies and conventional fossil fuels-based generation options. One way to accomplish this is by removing fossil fuel subsidies. The benefits—including the many positive externalities—of renewable energy generation tend to materialize in the medium to long term and accrue at the level of the entire country. Therefore, governments should capitalize on the benefits provided by these international bodies. Particularly, they should establish regulatory frameworks and incentive structures to effectively mobilize private sector actors, including infrastructure developers and financiers for technology development, infrastructure development and operation for renewable energy planning. The private sector will then engage in the operations of renewable energy generation at an appropriate scale.

· Establish public incentive mechanisms to attract private investment by:

o Setting clear national targets for renewable energy generation, thus providing certainty to private sector actors, reducing regulatory risks, and making subsequent public incentive instruments more reliable and trustworthy from the perspective of financiers;

o Introducing feed-in tariffs whereby long-term purchase contracts are offered to renewable energy producers at a fixed price or with a fixed premium to the market price; and

o Levying carbon taxes at a fixed amount of tax per ton of carbon dioxide emitted so that the market is steered away from high-emission fossil fuels into low-carbon alternatives.

· Make market liberalization efforts to provide easy market access and grid access to private sector actors on a competitive basis. Decentralize the domination of the state-owned national power utility, which is susceptible to political interference and aims to keep prices artificially low, thereby adversely affecting the sustainability of national power provision. Prices kept unsustainably low on political grounds also stifle innovation, reduce competition on electricity markets, and deter investment in the deployment of renewable energy technologies in SSA.

· Mitigate political and regulatory investment risk because high regulatory and macroeconomic risks necessitate expectations of higher returns for private investors.

o In the short run, international development banks, official development assistance agencies, and other such organizations can achieve this by providing hedging instruments and guarantees through official development assistance and international climate finance. These actors ensure credibility and offer safety nets to private sector actors in SSA.

o In the long run, however, the onus is on governments in the region to address the drivers of business risk in the region through fundamental reforms in the political, economic, and societal structures. Public institutions and the legal system must be stable and trusted to attract project sponsors and investors to deploy, install, operate, and finance renewable energy technologies.

The recommended policies should supplement the Regional Initiative for Sustainable Energy 2009-2020, which, by 2030, targets both universal electricity access for the region with cheaper electricity prices and an increased share of renewable electricity up to 82% (Muller et al. 2010). This target may seem ambitious, but the SSA region presents vast opportunities for both public and private investment in renewable energy. Consequently, it is projected that enforcement of these recommendations will make the region attractive for investors, strengthen the legitimacy of governments in the region, and, ultimately, bring the SSA population closer to gaining access to electricity sustainably.

SOURCES:

Actualitix. “Access to Electricity (% of Population).” World Bank. 2012. http://en.actualitix.com/country/wld/access-to-electricity.php

Deichmann, Uwe, Craig Meisner, Siobhan Murray, and David Wheeler. “The Economics of Renewable Energy Expansion in Rural Sub-Saharan Africa.” Policy Research Working Paper 5193. The World Bank Development Research Group Environment and Energy Team. January 2010. https://openknowledge.worldbank.org/bitstream/handle/10986/19902/WPS5193.pdf?sequence=1&isAllowed=y

International Energy Agency. “Africa Energy Outlook.” World Energy Outlook Special Report. OECD/IEA. 2014. https://www.iea.org/publications/freepublications/publication/WEO2014_AfricaEnergyOutlook.pdf

International Energy Agency. “Boosting the Power Sector in Sub-Saharan Africa: China’s Involvement.” OECD/IEA. 2016. https://www.iea.org/publications/freepublications/publication/Partner_Country_SeriesChina Boosting_the_Power_Sector_in_SubSaharan_Africa_Chinas_Involvement.pdf

International Energy Agency. “Global Renewable Energy.” 2017. http://www.iea.org/policiesandmeasures/renewableenergy/

International Energy Agency. “IEA Building Energy Efficiency Policies Database.” OECD/IEA. 2017. http://www.iea.org/beep/

International Energy Agency. “World Energy Outlook 2014 Factsheet.” 2014. https://www.iea.org/media/news/2014/press/141013_WEO_Africa_Energy_OutlookFactsheet1.pdf

International Energy Agency. “World Energy Outlook 2014 Factsheet.” 2014. https://www.iea.org/media/news/2014/press/141013_WEO_Africa_Energy_OutlookFactsheet3.pdf

Macri, Colin, Ryan Oros, and Ben Clark. “Bringing Electricity to Sub-Saharan Africa.” Autumn 2015. http://franke.uchicago.edu/bigproblems/BPRO29000-2015/Team17-EnergyFinalPaper.pdf

Muller, Simon, Ada Marmion, and Milou Beerepoot. “Renewable Energy: Markets and Prospects by Region.” International Energy Agency. November 2011. https://www.iea.org/publications/freepublications/publication/Renew_Regions.pdf

UN Data. “Renewable Energy Share in the Total Final Energy Consumption.” United Nations Statistics Division. 2017. http://data.un.org/Data.aspx?q=renewable+energy+Sub+Saharan+ Africa&d=SDGs&f=series%3aEG_FEC_RNEW%3bref_area%3aMDG_NAFR%2cMDG_SS A%2cZAF

UN-Energy/Africa. 2007. Energy for Sustainable Development: Policy Options for Africa. United Nations. New York.

United Nations Environment Program. “Financing Renewable Energy in Developing Countries.” February 2012. http://www.unepfi.org/fileadmin/documents/Financing_Renewable_Energy_in_subSaharan_Africa.pdf

Zaitchik, Benjamin. Lectures. Johns Hopkins University School of Advanced International Studies. Washington, D.C. Spring 2017.

PHOTO CREDIT: Photo from Max Pixel licensed under Creative Common Zero - CCO