BY CHETAN HEBBALE

Chetan Hebbale is a Master of International Relations student specializing in Development, Climate, and Sustainability, International Economics and Finance, and China. He has worked on public sector strategy and decarbonization solutions at Deloitte, the Climate Policy Initiative, and the White House Council on Environmental Quality.

Introduction

The global energy system is going through a series of profound shocks. The combination of Russia’s invasion of Ukraine and COVID-19 have structurally altered oil and gas markets and energy supply chains, while the growing recognition that climate change can no longer be ignored is directing trillions of dollars of capital away from fossil fuels and towards low-carbon technologies.

One such technology is “green hydrogen”— touted as the missing piece to solving the energy transition.[1] It has the potential to substantially decarbonize transportation as well as hard-to-abate industrial, power, and heating processes. More than 30 countries have developed national hydrogen strategies [2] and agreed at COP26 and COP27 to accelerate the deployment of green hydrogen.[3] [4] As a result, hydrogen could fulfill a quarter of total energy demand by 2050. [5]

This anticipated boom carries significant geopolitical implications. New hydrogen export champions will change the geography of the global energy trade, presenting new trade route vulnerabilities, as well as, potentially, new political alliances. Additionally, a new dimension of global energy competition will unfold over the green hydrogen supply chain where China is already leading. To facilitate the growth of hydrogen in line with net-zero goals, nations will have to protect new trade routes, engage in substantive hydrogen diplomacy, and invest in new capacities for critical technologies like electrolyzers and fuel cells.

HYDROGEN’S ROLE IN A DECARBONIZED ECONOMY

Hydrogen has been used as a staple of the chemical and energy industries for decades. Around 120 million tons are produced annually and used primarily as a feedstock in crude oil refining, synthesizing ammonia for fertilizer, and methanol production, which goes into a number of products including plastic.[6]

Hydrogen’s decarbonization potential centers around transportation, energy storage, power generation, and industrial heating processes. In fuel cells, hydrogen chemically reacts with oxygen to produce electricity without releasing any greenhouse gasses. These fuel cells can be used to power trucks and light-duty cars, like the 2022 Toyota Mirai,[7] as well as provide onsite power generation for homes and commercial businesses, as is being done by Adobe, Apple, and Microsoft.[8] For policymakers, hydrogen being storable, dispatchable, and a potential zero-emission source of energy and heat at any time of the day is especially attractive.

Even more exciting is hydrogen’s potential to clean up hard-to-abate sectors of the economy. Ammonia synthesized from clean hydrogen, known as e-ammonia, can be used to power shipping vessels, which could effectively decarbonize 90% of worldwide trade.[9] Hydrogen can also be burned as a fuel to generate heat at extremely high temperatures (greater than 1,000°C) without emitting CO2.[10] This enables it to decarbonize the production of industrial products like steel and cement, which account for 15% of all global emissions.[11]

However, hydrogen is an energy carrier, not an energy source.[12] The significance of this distinction is that it must be produced from another substance, usually by splitting water molecules or fossil fuels. These extraction methods are color-coded to signify how the hydrogen was produced. 95% of today’s supply is “grey” hydrogen, which is produced from fossil fuels through natural gas steam methane reforming or coal gasification.[13] The two most prominent alternatives are “blue” or “green” hydrogen.

Blue hydrogen is simply grey hydrogen, but the emissions are pumped below ground using carbon capture technology. Green hydrogen is produced with an electrolyzer which splits water into oxygen and hydrogen using electricity generated by renewable energy. This process, known as electrolysis, produces no carbon emissions. Green hydrogen represents only 3% of total hydrogen production,[14] but is expected to become the dominant production pathway by 2050 as the cost of solar PV and wind continue to decline.[15]

HOW GREEN HYDROGEN WILL DISRUPT THE GLOBAL ENERGY MAP

Today, hydrogen consumption is highly localized— nearly 85% of hydrogen produced is consumed on-site, usually at a refinery.[16] But, in the last few years, more than 30 countries and regions have released or are preparing national hydrogen strategies, which is setting the stage for a boom in the cross-border hydrogen trade. The demand for green hydrogen as an internationally traded commodity will spur new investment flows, trade relations, and interdependence between nations that have not traditionally traded energy.

As a result, the geopolitics of the global energy trade will change in four ways: (1) the introduction of new energy export champions, (2) geographic vulnerabilities along hydrogen trade routes, (3) new alliance configurations and the growth of hydrogen diplomacy, and (4) a technology race to secure the green hydrogen supply chain.

NEW ENERGY EXPORT CHAMPIONS

Unlike oil and gas, green hydrogen can theoretically be produced anywhere, but states will benefit from international trade by acquiring it from countries who have a comparative advantage in the availability of renewable energy, freshwater, and necessary export infrastructure. The countries with the biggest advantage in green hydrogen comprise some new players on the global energy scene, including:

Australia: In 2019, Australia released its national hydrogen strategy, positioning itself to become one of the top green hydrogen exporters due to its abundance of renewable resources. It has invested more than $1 billion in its hydrogen industry and forged a series of bilateral export deals with Germany, Japan, and Singapore.[17]

Chile: In 2020, Chile launched a green hydrogen strategy aiming to produce 25 GW of capacity and become the world’s cheapest source of hydrogen by 2030 and a top three global exporter by 2040. It’s estimated that it will sell $30 billion in green hydrogen by the end of the decade, taking advantage of its solar and wind resources.[18]

Morocco: In 2021, Morocco released a green hydrogen roadmap and is estimating an export market of 10 terawatt hours (TWh) by 2030 [19] on the back of its strong solar industry.[20] IRENA acknowledged the importance of this market by recently signing a partnership to expand Morocco’s green hydrogen investment.[21]

Where will this green hydrogen go? The primary nations who have staked their energy future on hydrogen include:

Japan: In 2017, Japan was the first to adopt a national hydrogen strategy declaring that it would become a “hydrogen society.”[22] Since then, the government has started building a massive infrastructure to import and distribute hydrogen, including a $670 million investment in 2020 to build nearly a million fuel cell vehicles and 900 hydrogen fueling stations.[23]

South Korea: In 2019, South Korea instituted a national hydrogen roadmap pledging to use hydrogen to power 30% of cities and towns by 2040. It has already deployed the most fuel cell vehicles in the world at around 10,000 and aspires to reach 200,000 vehicles by 2025.[24]

Germany: In 2020, Germany unveiled its own national hydrogen strategy, investing 7 billion euros in hydrogen business and infrastructure and pledging to produce 10 GW of power from hydrogen by 2040.[25]

GEOGRAPHIC VULNERABILITIES ALONG HYDROGEN TRADE ROUTES

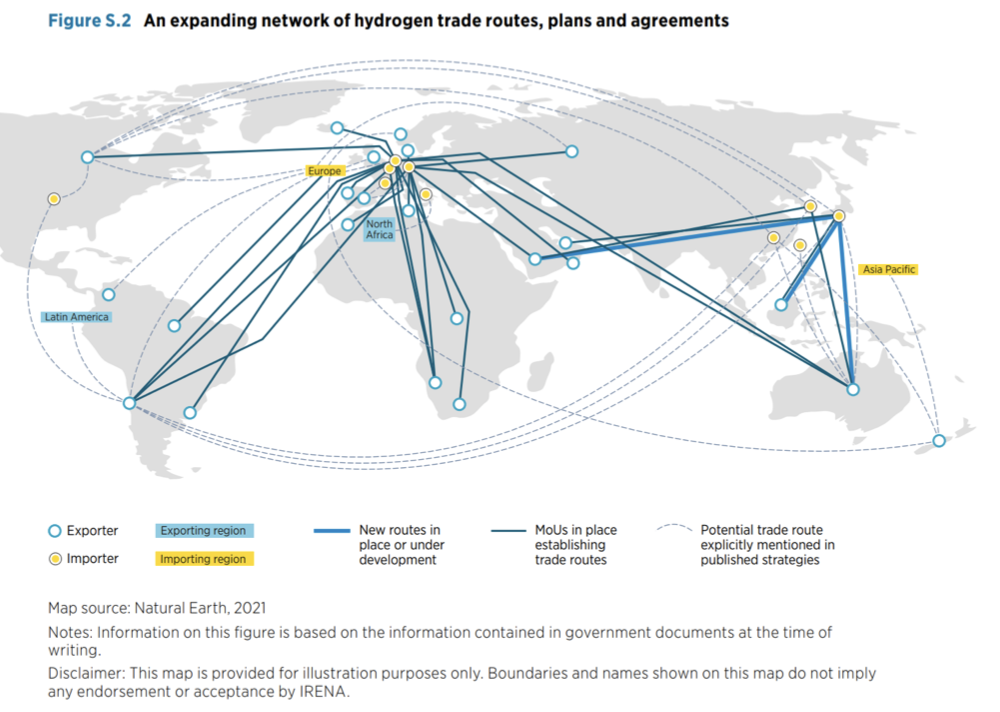

Regional and global hydrogen trade is in its early stages. Figure S.2 below provides an overview of the potential trade routes from green hydrogen exporting regions in Latin America, Asia Pacific, and Northern Africa crisscrossing around the world to major importers.

Source: International Renewable Energy Agency (IRENA), 2022 [26]

Hydrogen can be transported in two ways, via pipeline or shipping. The overseas hydrogen trade will give rise to new important shipping lanes, which will also present themselves as vulnerable maritime choke points, much like the Strait of Hormuz in the Persian Gulf for oil. One prominent green hydrogen shipping route from Australia to Japan would run through the East China Sea, which has been prone to territorial disputes between China and Japan.[27]

Similarly, transporting green hydrogen via pipeline from northern Africa to Europe will place transit countries in vulnerable positions much like Ukraine and other critical transit countries in the natural gas market.

These vulnerabilities will inform strategic planning and defense considerations, and, ultimately, could result in new alliances on a bilateral basis centered around hydrogen access and security.

NEW ALLIANCES AND THE GROWTH OF HYDROGEN DIPLOMACY

As importer nations look to secure access from emerging export champions, hydrogen diplomacy will become a standard fixture of economic and energy diplomacy. Indeed, the Netherlands was the first to appoint a dedicated “hydrogen envoy” in 2019 as part of efforts to ink deals with Chile, Namibia, Portugal and Uruguay as potential suppliers.[28]

Germany has not only established bilateral hydrogen deals with Australia, Chile, Morocco, Namibia, Tunisia, and Ukraine, but also set up dedicated hydrogen diplomacy offices in those countries.[29] Japan is engaged in similar diplomacy to establish hydrogen value chains with Australia, Brunei, Norway, and Saudi Arabia. Chile declared that it would use “green hydrogen diplomacy” to attract foreign investment and unleash its export potential.[30]

Profound geopolitical shifts could occur under these new alliances. For example, Germany’s bilateral hydrogen deals could wean its dependence off of Russian natural gas. OPEC might find its influence dimming in Japan, which imports nearly 90% of its oil from the Middle East,[31] as it opts to substitute oil for hydrogen fuel cells to power cars and buildings.

THE TECHNOLOGY RACE FOR THE GREEN HYDROGEN SUPPLY CHAIN

Underlying these shifts will be an intense competition for the green hydrogen supply chain, especially electrolyzers and fuel cells. Europe is currently the largest manufacturer of electrolyzers, but China is vastly beating them on cost with standard alkaline electrolyzers (the most common type) that are 83% cheaper.[32] Moreso, China dominates the access to, and ability to process, raw materials like nickel and zirconium needed to produce electrolyzers and platinum-group metals for fuel cells.[33]

China is the world’s largest producer and consumer of hydrogen (almost entirely grey), leads the world in deploying fuel cell trucks and busses, and has named hydrogen as one of its six industries of the future.[34] This presents a risk that large parts of the green hydrogen supply chain will ultimately be controlled by China, subjecting it to the political volatility seen in other goods caught in global trade disputes and protectionist measures.

Although it may be too late to compete with China on cost, Western nations could innovate by maturing solid oxide and proton exchange membrane technologies, which are superior to China’s alkaline electrolyzers in utilizing various renewable energy resources.[35] The market for hydrogen technologies is still relatively small, with upcoming gigafactories for large-scale production of electrolyzers in Australia, France, India, Italy, Norway, Spain and the United Kingdom holding the possibility to drastically change the current manufacturing landscape.[36]

Some estimates indicate that, by 2050, there will be a $50-60 billion market for electrolyzers and $21-25 billion for fuel cells.[37] Thus, the hydrogen trade will add another dimension to existing geo-economic rivalries and will become a new battleground between major powers and emerging economies for supply chain security and technological superiority.

Conclusion

The energy transition is fraught with risks and challenges amidst concurrent global crises. As nations look for viable alternatives to secure a reliable flow of energy while working to combat climate change, green hydrogen has the potential to be a true game-changer in the fight for net-zero. It can power fuel cell electric vehicles, store renewable energy at utility scale, and be burned as a substitute fuel in carbon intensive industrial processes without releasing CO2. As interest in hydrogen grows, new players, alliances, vulnerabilities, and supply chain competition will arise.

While countries like Japan, South Korea and Germany prepare to become significant importers, countries like Australia, Chile, and Morocco stand to gain geopolitical status as new export champions. But, in order to make this vision real, these countries will depend on critical production and distribution technologies that are controlled by China, for now. Hydrogen diplomacy, technological innovation, and new security alliances will be pivotal to ensure that green hydrogen lives up to its promise of solving a key part of the clean energy puzzle.

PHOTO CREDIT: rcphotostock

References

[1] Noé van Hulst, “Hydrogen, the missing link in the energy transition,” International Energy Agency, October 17th, 2018, https://www.iea.org/commentaries/hydrogen-the-missing-link-in-the-energy-transition.

[2] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg.39, 2022,

[3] Cato Koole and Thomas Koch Blank, “COP26 Made Clear That the World Is Ready for Green Hydrogen,” Rocky Mountain Institute, November 23rd, 2021, https://rmi.org/cop26-made-clear-that-the-world-is-ready-for-green-hydrogen/.

[4] GH2, “Green Hydrogen at COP27,” https://gh2.org/event/green-hydrogen-cop27

[5] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 24, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[6] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 24, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[7] Toyota, “2022 Mirai,” https://www.toyota.com/mirai/.

[8] Fuel Cell & Hydrogen Energy Association, “Stationary Power,” https://www.fchea.org/stationary.

[9] Gabriel Castellanos, Roland Roesch and Aidan Sloan, “A Pathway to Decarbonise the Shipping Sector by 2050,” International Renewable Energy Agency, October 2021, https://www.irena.org/publications/2021/Oct/A-Pathway-to-Decarbonise-the-Shipping-Sector-by-2050.

[10] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 24, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[11] Rebecca Dell, “Making the Concrete and Steel We Need Doesn’t Have to Bake the Planet,” The New York Times, March 4th, 2021, https://www.nytimes.com/2021/03/04/opinion/climate-change-infrastructure.html.

[12] Marc Rosen, “Natural and Additional Energy,” THEORY AND PRACTICES FOR ENERGY EDUCATION, TRAINING, REGULATION AND STANDARDS, 2004, http://www.eolss.net/sample-chapters/c08/E3-03-05-01.pdf.

[13] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[14] International Energy Agency, “The Future of Hydrogen,” June 2019, https://iea.blob.core.windows.net/assets/9e3a3493-b9a6-4b7d-b499-7ca48e357561/The_Future_of_Hydrogen.pdf.

[15] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[16] International Energy Agency, “The Future of Hydrogen,” June 2019, https://iea.blob.core.windows.net/assets/9e3a3493-b9a6-4b7d-b499-7ca48e357561/The_Future_of_Hydrogen.pdf.

[17] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 52, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[18] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 48, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[19] Ibid.

[20] Aida Alami, “How Morocco went big on solar energy,” BBC, November 18th, 2021, https://www.bbc.com/future/article/20211115-how-morocco-led-the-world-on-clean-solar-energy.

[21] IRENA, “Morocco and IRENA Partner to Boost Renewables and Green Hydrogen Development,” June 10th, 2021, https://www.irena.org/newsroom/pressreleases/2021/Jun/Morocco-and-IRENA-Partner-to-Boost-Renewables-and-Green-Hydrogen-Development.

[22] Monica Nagashima, “Japan’s Hydrogen Strategy and Its Economic and Geopolitical Implications,” French Institute of International Relations, October 8th, 2018, https://www.ifri.org/en/publications/etudes-de-lifri/japans-hydrogen-strategy-and-its-economic-and-geopolitical-implications.

[23] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg.41, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[24] Ibid.

[25] Rossana Scita, Pier Paolo Raimondi and Michel Noussan, “Green Hydrogen: The Holy Grail of Decarbonisation? An Analysis of the Technical and Geopolitical Implications of the Future Hydrogen Economy,” Fondazione Eni Enrico Mattei, October 2020, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3709789.

[26] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 12, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[27] Fridolin Pflugmann and Nicola De Blasio, “Geopolitical and Market Implications of Renewable Hydrogen,” Environment and Natural Resources Program - Belfer Center for Science and International Affairs, March 2020, https://www.belfercenter.org/sites/default/files/files/publication/Geopolitical%20and%20Market%20Implications%20of%20Renewable%20Hydrogen.pdf.

[28] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 79, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[29] Ibid.

[30] Ibid. 28.

[31] U.S. Energy Information Administration, “Country Analysis Executive Summary: Japan,” October 2020, https://www.eia.gov/international/content/analysis/countries_long/Japan/japan.pdf.

[32] Thijs Van de Graaf, Indra Overland, Daniel Scholten, Kirsten Westphal, “The new oil? The geopolitics and international governance of hydrogen,” Energy Research & Social Science, Volume 70, December 2020, https://www.sciencedirect.com/science/article/pii/S2214629620302425?via%3Dihub.

[33] Rajesh Chadha, “Skewed critical minerals global supply chains post COVID-19: Reforms for making India self-reliant,” Brookings India, June 10th, 2020, https://www.brookings.edu/wp-content/uploads/2020/06/Skewed-critical-minerals-global-supply-chains-post-COVID-19.pdf.

[34] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 40, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[35] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 62, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.

[36] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 61, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf

[37] International Renewable Energy Agency (IRENA), “Geopolitics of the Energy Transformation: The Hydrogen Factor”, pg. 59, 2022, https://irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf.